The Panic of 1837, alternatively known as the "wild cat" panic, was a commercial collapse of the US economy that occurred under the Van Buren administration. However, the crash and subsequent aftermath is mainly credited to Andrew Jackson as a direct result of his poor economic policies.

What is the context for the panic?

The foundation of the US economy was tumultuous during the 19th century and was characterized by frequent and severe market fluctuations. As a result of the volatility of the markets there was a the plethora of panics that occurred during the 19th century, such as the panics of 1819, and 1873. In time, it was this economic instability, paired with misguided economic policy, that created the perfect storm that provoked the Panic of 1837.

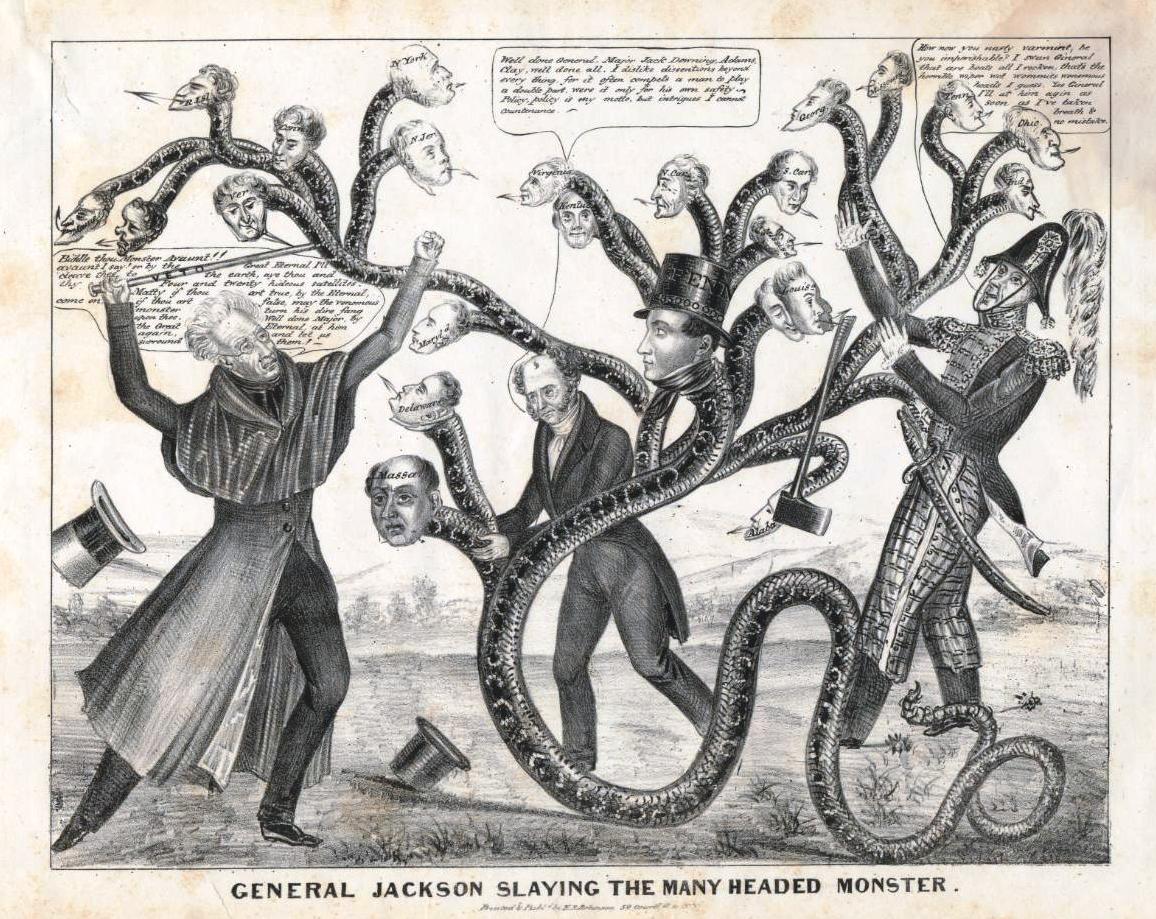

The Second Bank of the United States (B.U.S.), established in 1816 and headed by Nicholas Biddle, was created as a safeguard and was intended to ensure financial stability in the U.S. economy. In 1832 Biddle attempted to renew charter of the B.U.S., which was set to expire in 1836. However, the renewal was vetoed by Jackson, calling it unconstitutional and "a manifesto of anarchy," and after he was reelected in the election of 1832 Jackson immediately moved to destroy the bank. He began to transferr federal funds from the B.U.S. to state banks (commonly referred to as "pet banks") in an effort to spite Biddle.

Jackson's quarrels with the B.U.S. stemmed from his belief that the bank was unduly favoring the commercial interests of the northeastern states and that it was harmful to the state-chartered banks of the West. Moreover, Jackson long had a distrust of paper-money after a poor investment with a speculator left him in debt. Jackson sought to dismantle the B.U.S. because he perceived it as an instrument of great privilege and power, independent of government control, that was unfairly controlled by Biddle. His distrust was so great he declared that “[the] bank is trying to kill me, but I will kill it!”

What was the Bank War?

The Bank War was a back-and-forth between Jackson and Biddle over their differing views of the B.U.S. and how the US economy should behave. The bank war began after Jackson's veto for the renewal of the B.U.S. This action led to a grueling political struggle between the two, known as the Bank War. In response, Biddle began giving easy loans to influential congressmen and newspapermen. It is said that a prominent New York newspaper that had opposed the B.U.S. began supporting it after receiving a secret $15,000 loan.

In retaliation, in 1832, Jackson ordered the withdrawal of ten-million dollars of federal government funds from the B.U.S. which he then deposited in privately-owned financial institutions and "pet banks." As a result of this incredible cash injection, state banks began loaning incredible amounts of money to industrialists and farmers and printing exorbitant amounts of currency. This immediately generated high inflation. Simultaneously, foreign governments and businesses loaned large sums of money to U.S. businessmen, hoping to benefit from the United States' booming economy. Even higher inflation resulted, and with that the value of US currency depreciated.

- Specie: Money or currency in the form of coins rather than notes.

In 1836 Jackson issued an executive order called the Specie Circular which stipulated that the government would only accept payment for federal land in gold or silver. This was a result of the rapid depreciation of US currency and high inflation. The money that the "pet banks" had printed and distributed became worthless. The unfortunate consequence was that due to the small amount of specie in circulation, state banks were unable to meet the specie requirements put in place by the executive order, which in turn caused many to collapse.

In an attempt to get federal deposits back and correct the high inflation, Biddle's response was to withdraw a large amount of funds. This action inteded to bring about a short depression through the restriction of credit and curtail of loans throughout the nation. He also encouraged holders of state bank notes to redeem them in gold and silver as quickly as possible. Biddle’s contractionary policy unintentionally unleashed mass speculative binge backed by the deposit of funds.

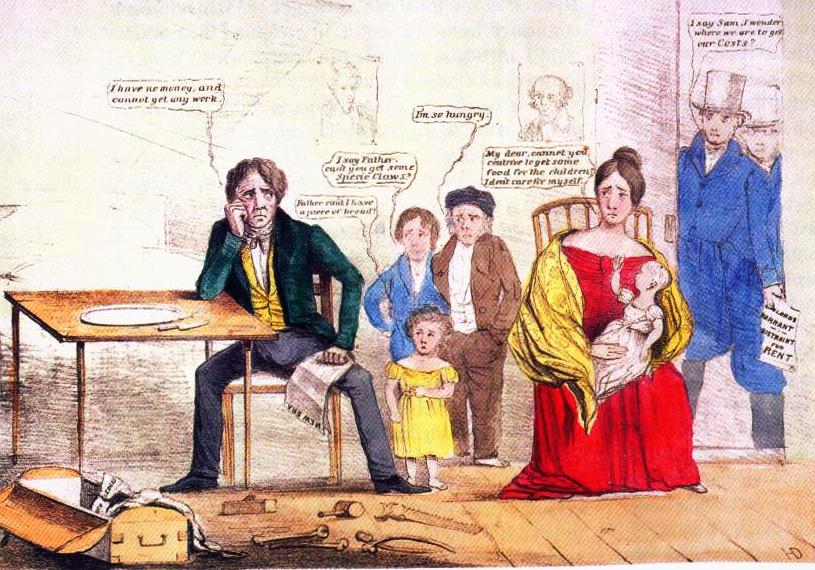

With a highly devalued currency, limited supply of specie in circulation, and the inability of banks to redeem their self-issued notes in cash the Panic of 1837 was launched. Hundreds of banks crashed and entire business sections and industries in some cities faltered. The price of cotton plunged and everywhere throughout the nation, there was joblessness, hunger, and misery.

So what exactly caused the panic?

Ultimately, the combined factors of Jackson’s mistrust of Biddle, the Specie Circular, and Jackson’s actions against the B.U.S., as seen in the transfer of federal funds from the B.U.S. to “pet banks,” led to the economic boom. This high inflation and the exorbitant amount of paper currency that state banks loaned out led to swift depreciation and eventually a crash.

What was the political response to the panic?

Ultimately, the effects of the panic would linger until the mid-1840s. Still, after the election of 1836 and the introduction of the Van Buren administration, Congress passed the Independent Treasury Bill in 1840 which made the federal government independent of the privately-owned banking system. The bill set a precedent in that it required that government funds were thereafter to be deposited government subtreasuries rather than privately owned banks. The act paved the way for modern-day banking procedures.